Have you ever filled a prescription for a generic drug and been shocked by the price-only to find out your friend in another state paid a third of what you did? It’s not a mistake. It’s not a glitch. It’s the system. Generic drugs, which make up 90% of all prescriptions in the U.S., don’t have a national price. They have dozens of prices, depending on where you live.

Why the Same Pill Costs More in One State Than Another

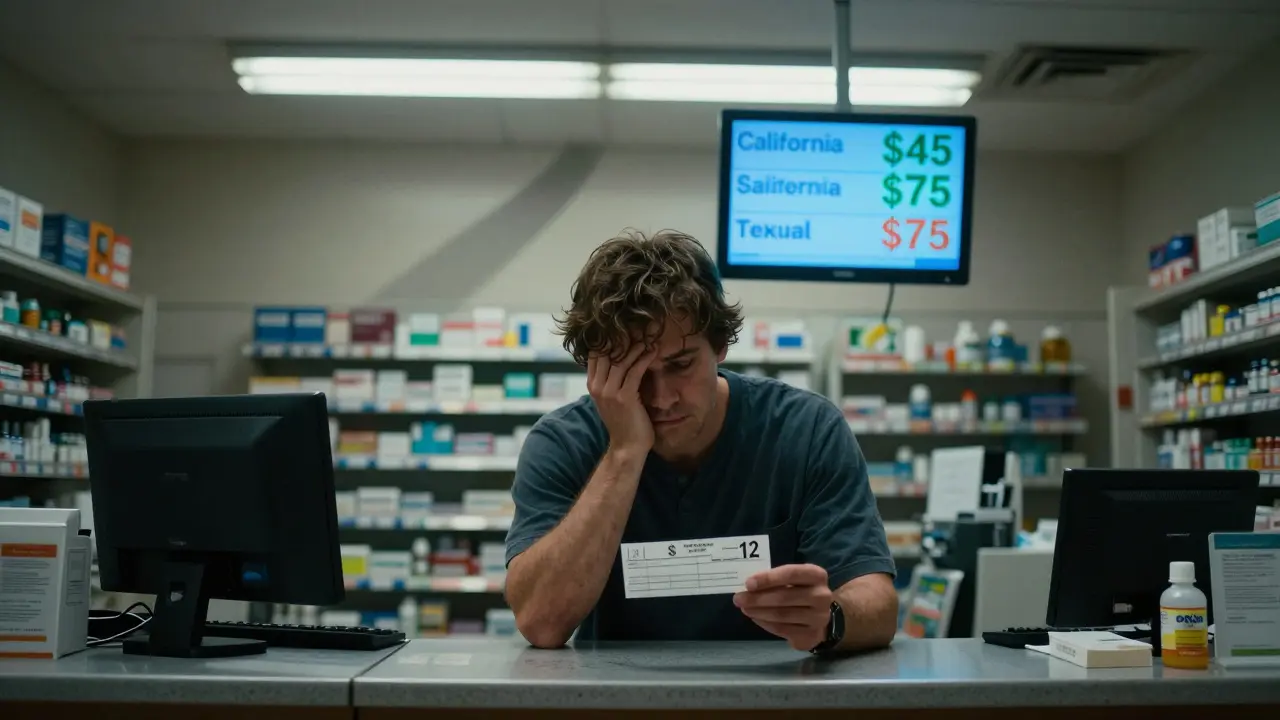

The same 30-day supply of generic atorvastatin-used to lower cholesterol-can cost $12 in Ohio and $45 in California. In some rural areas of Texas, it’s $75. Why? Because no single agency sets the price. Instead, it’s a tangled web of pharmacy benefit managers (PBMs), state Medicaid rules, insurance contracts, and local competition.PBMs are the middlemen between drug manufacturers, insurers, and pharmacies. They negotiate prices behind closed doors, and what they agree to in one state doesn’t apply in the next. Some PBMs charge pharmacies a fixed fee per prescription, others use complex rebate systems that vary by state. And because these deals are secret, patients rarely know what they’re really paying until they get the bill.

How States Try (and Fail) to Control Prices

Over the past decade, more than 100 state bills aimed at controlling drug prices were introduced. Vermont led the way in 2016 with transparency laws requiring drug makers to justify price hikes. California followed with similar rules. Maryland tried something bolder: a law that banned price gouging on generic drugs. It didn’t last. In 2018, a federal court struck it down, saying states can’t interfere with interstate commerce.That ruling sent a chill through other states. Nevada passed a law targeting diabetes drug prices-but the lawsuit behind it was dropped. Why? Because manufacturers and PBMs threatened to sue under federal trade secrets law, forcing the state to back down. Now, most states stick to transparency. They force companies to report price changes. But reporting isn’t the same as controlling.

The Medicaid Factor: Reimbursement Rules Vary Wildly

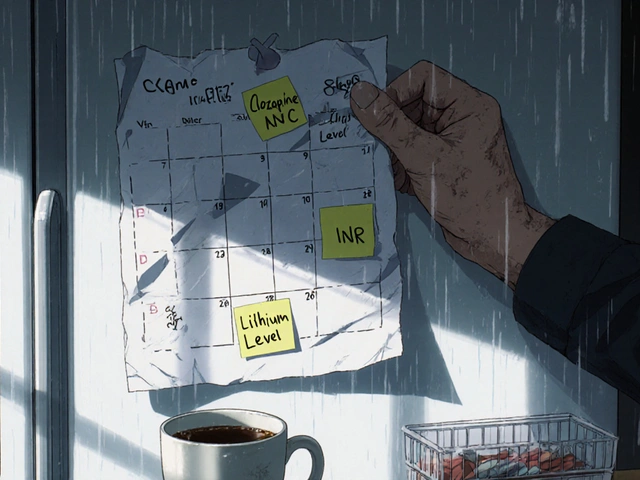

Medicaid pays for a huge chunk of generic drugs, especially in low-income communities. Each state sets its own reimbursement rate, and that rate directly affects what pharmacies charge. Some states use the National Average Drug Acquisition Cost (NADAC), which updates monthly based on wholesale prices. Others use older benchmarks or even cap payments at a fixed dollar amount.Here’s the kicker: if Medicaid pays $5 for a drug, a pharmacy might charge a private patient $20. If Medicaid pays $12, the same pharmacy might charge $25. It’s not about the cost of the pill-it’s about what the state will reimburse. And that number changes every year, based on political pressure, budget cuts, or lobbying.

Competition (or Lack of It) Drives Prices Up

In big cities, you’ve got CVS, Walgreens, Walmart, Target, and local pharmacies all competing for your business. That competition pushes prices down. In rural areas? You might have one pharmacy. One choice. No competition. And that pharmacy can charge more-because you have nowhere else to go.GoodRx data from 2022 showed price differences of up to 300% for the same generic drug between neighboring counties in states like Arizona and Georgia. One town had a $12 price for metformin. Ten miles away, it was $48. The drug didn’t change. The distance did.

Why Paying Cash Often Beats Insurance

Here’s the most counterintuitive truth: if you’re paying for a generic drug, using your insurance might cost you more than paying cash.Why? Because insurers and PBMs have complex contracts that inflate prices. Your copay might look low-$10, $15-but the actual cost of the drug is hidden. PBMs collect rebates from manufacturers, but those savings rarely reach you. Instead, they pad their profits.

Studies show that when patients pay cash for generics, they save 30% to 70% compared to using insurance. That’s why services like GoodRx, Blink Health, and Mark Cuban’s Cost Plus Drug Company are booming. A 90-day supply of lisinopril? $4 cash at a pharmacy in Florida. $38 with insurance in New York. Same pill. Same manufacturer. Different state. Different price.

The Inflation Reduction Act Didn’t Fix This

The 2022 Inflation Reduction Act capped insulin at $35 a month for Medicare patients and set a $2,000 annual out-of-pocket limit on drug costs starting in 2025. That’s huge-for seniors. But it doesn’t help the 70% of Americans under 65 who get their drugs through private insurance or pay out of pocket.And even for Medicare patients, the savings depend on your state. In states with strong transparency laws, patients saw 8-12% lower prices for generics. In states without those laws? Not much changed. The federal cap helps, but it doesn’t fix the broken system underneath.

What You Can Do Right Now

You can’t change state laws. But you can change how you pay.- Always check GoodRx or SingleCare before filling a prescription-even if you have insurance.

- Ask your pharmacist: “What’s the cash price?” Often, it’s lower than your copay.

- If you’re on Medicare, use the Medicare Plan Finder tool to compare drug costs in your area.

- For chronic conditions like high blood pressure or diabetes, consider mail-order pharmacies or direct-purchase services like Cost Plus Drug Company.

- If you live in a state with drug price transparency laws (California, Colorado, Maine, Nevada, Vermont, Washington), use their online databases to compare prices before you buy.

Don’t assume your insurance is helping. It might be the reason you’re paying more.

What’s Next? The Fight Is Just Beginning

As of 2025, 18 states have created drug affordability review boards. These panels can investigate price spikes and recommend limits-but they can’t enforce them. That’s the problem. Without teeth, they’re just advisory.Meanwhile, PBMs are still making billions. In 2023, the top three PBMs controlled over 80% of the market. Their parent companies are among the largest healthcare corporations in the country. They profit from complexity. And as long as prices stay opaque, they’ll keep winning.

But consumers are catching on. More people are paying cash. More are switching pharmacies. More are asking questions. That’s the first step. Until we demand transparency-and hold PBMs accountable-generic drug prices will keep varying wildly, state by state, pharmacy by pharmacy, person by person.

You’re not overpaying because you’re unlucky. You’re overpaying because the system is rigged. And the only way to fix it is to stop accepting it.

Randolph Rickman

December 15, 2025 AT 21:30Man, I just checked my last prescription for metformin-$42 with insurance. Cash? $12 at Walmart. I felt like I’d been robbed until I learned the truth. This post nailed it. Insurance isn’t helping-it’s the middleman playing chess with your wallet.

Start using GoodRx. Always. Even if you think you’re covered. You’re not.

Dan Padgett

December 16, 2025 AT 02:06It’s wild how something so basic-medicine-becomes this labyrinth of greed. You’d think a pill is a pill. But no. It’s a contract. A secret handshake. A corporate tax write-off with your name on it.

I used to trust insurance. Now I just ask the pharmacist: ‘Cash price?’ And I walk away with my dignity-and my wallet-intact.

Arun ana

December 16, 2025 AT 19:19Wow, this is so eye-opening 😮 I had no idea cash could be cheaper than insurance! I’ll definitely try GoodRx next time. Thanks for sharing this! 🙏

Kayleigh Campbell

December 18, 2025 AT 00:09So let me get this straight-my insurance company gets paid by the manufacturer to charge me more, and I’m supposed to be grateful?

Ohhhhh, that’s why my copay’s ‘only’ $15. It’s not a discount. It’s a trap. I’m basically paying to be scammed. Thanks, America.

Also, if you’re still using insurance for generics, you’re doing it wrong. Just sayin’.

Kim Hines

December 19, 2025 AT 11:25I’ve been paying cash for my blood pressure med for two years now. $4 a month. I used to think I was being cheap. Turns out I was just smart. Nobody talks about this. Everyone just accepts it. Sad.

Cassandra Collins

December 21, 2025 AT 11:01Ok but have you ever thought this is all a Big Pharma psyop? They work with PBMs to make prices confusing so you don’t realize you’re being controlled. The government knows. They just don’t care. Why? Because they’re paid. I saw a documentary-there’s a hidden code in the billing system. It’s all linked to satellite data. I’m not joking. Google ‘PBM shadow network 2023’.

Joanna Ebizie

December 21, 2025 AT 22:33Wow. You people are still surprised by this? You live in America. You think anything here is fair? You pay $200 for a $3 pill and cry about it like it’s a surprise. Grow up. The system’s designed to bleed you dry. You’re not a patient. You’re a revenue stream.

Elizabeth Bauman

December 22, 2025 AT 10:13Foreigners think we’re stupid. They don’t get it. This isn’t about greed-it’s about protecting American innovation. PBMs? They’re just keeping the system running. If we let states set prices, we’d have chaos. And China would take over drug manufacturing. We need structure. Not chaos. And if you’re paying cash? Good for you. But don’t hate the system-it’s keeping you alive.

Dylan Smith

December 23, 2025 AT 21:51So if Medicaid pays $5 and the pharmacy charges $20 to private patients, that means the pharmacy is making $15 profit on a $5 drug? That’s insane. Why don’t we just cap the markup? Why does every state do it differently? This feels like a loophole designed by lawyers who hate people

Also why is no one talking about how PBMs own pharmacies now? That’s the real problem. It’s all one big corporate loop.