By the end of 2024, millions of Medicare beneficiaries will face a final year of the donut hole-a confusing and costly coverage gap in Medicare Part D. But starting January 1, 2025, it’s gone for good. The $2,000 annual out-of-pocket cap on prescription drugs is here, and it’s changing everything. If you’re still in the coverage gap this year, you need to know how to protect yourself before it disappears.

What the Donut Hole Really Means in 2024

The donut hole isn’t a mystery anymore-it’s a phase in your Medicare drug plan where you pay more out of pocket after your plan and you have spent a certain amount on covered drugs. In 2024, that threshold is $5,030 in total drug costs. Once you hit that number, you enter the coverage gap. For most people, this means paying 25% of the cost for both brand-name and generic drugs. But here’s the twist: the 25% you pay isn’t the whole story. For brand-name drugs, the manufacturer gives you a 70% discount. That discount counts toward getting you out of the gap. For generics, there’s no manufacturer discount, so you’re paying the full 25% with no help. That’s why people on expensive brand-name medications often escape the donut hole faster than those on generics. For example, someone taking Humira or Repatha might spend $3,300 out of pocket before reaching catastrophic coverage. Someone on generic blood pressure pills could spend $6,000 before the same point. That’s not fair-and that’s why the system is changing.Why the Donut Hole Is Disappearing in 2025

The Inflation Reduction Act of 2022 didn’t just promise change-it delivered it. Starting January 1, 2025, the donut hole vanishes. Instead of four phases, Medicare Part D will have three: deductible, initial coverage (up to $2,000 out of pocket), and catastrophic coverage (where you pay nothing). That $2,000 cap is huge. Right now, the average beneficiary who hits the donut hole spends about $7,050 out of pocket before catastrophic coverage kicks in. In 2025, that number drops to $2,000. For seniors on expensive medications, that’s a savings of $5,000 a year. Kaiser Family Foundation estimates that 19% of Medicare Part D enrollees reached the gap in 2022. Those people saved an average of $980 annually just from the reduced coinsurance rates since 2010. In 2025, they’ll save even more-and many won’t even realize they were in the gap because it won’t exist anymore.How to Lower Your Costs Before the Donut Hole Ends

If you’re approaching the coverage gap in 2024, don’t wait until you’re in it to act. Here’s what works right now:- Check your plan’s formulary tier. Drugs are grouped into tiers. Tier 1 and 2 drugs cost less. If your medication is on Tier 3 or 4, ask your doctor if a similar drug on a lower tier is safe for you.

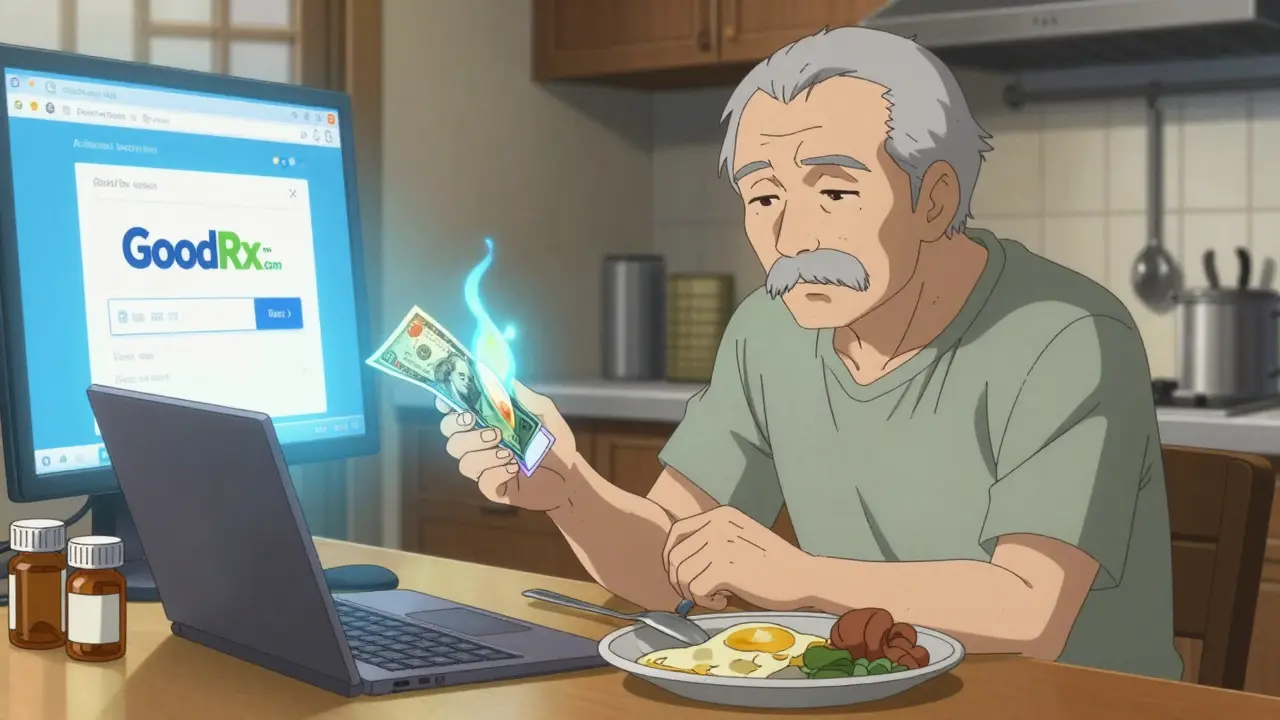

- Switch to generics. GoodRx found that switching from brand to generic can save $1,200 to $2,500 a year. For example, switching from Lipitor to atorvastatin saves $80 a month. That’s $960 a year-money you can use to stretch your budget through the gap.

- Use 90-day mail-order prescriptions. Many plans charge less for 90-day supplies. You might pay $20 for a 30-day supply, but only $45 for 90 days. That’s a 25% drop in your monthly cost.

- Apply for Extra Help. If your income is below $21,590 (single) or $29,160 (married), you qualify for the Low-Income Subsidy. It covers your deductible, lowers your copays, and eliminates the donut hole entirely. Over 12 million people qualified in 2023-and many didn’t know it.

- Use manufacturer patient assistance programs. Companies like Amgen, AbbVie, and Pfizer offer discounts or free drugs to people who qualify. One beneficiary reduced her Repatha cost from $560 to $5 a month during the gap. These programs aren’t advertised-you have to ask.

Don’t Skip Doses or Split Pills

A survey by the Medicare Rights Center found that 32% of people who hit the donut hole skipped doses because they couldn’t afford their meds. Another 19% split pills. That’s dangerous. Skipping insulin for diabetes? Risking a hospital stay. Cutting heart medication in half? Increasing your chance of a stroke. The cost of avoiding your meds isn’t just financial-it’s life-threatening. Instead of cutting pills, use the tools above. Talk to your pharmacist. Call your drugmaker. Ask your doctor about alternatives. There are options. You don’t have to choose between medicine and food.Use the Medicare Plan Finder Before Next Year

Your plan changes every year. What was cheap in 2023 might be expensive in 2025. Use the Medicare Plan Finder tool to compare drug costs across plans. Type in your exact medications, dosages, and pharmacy. It shows you which plan will cost the least. The National Council on Aging found that people who use this tool save an average of $1,047 a year. That’s more than enough to cover a year’s worth of copays in 2024-and it’ll help you pick the best plan for 2025’s new rules.

What Happens to Manufacturer Discounts After 2024?

The current manufacturer discount program ends December 31, 2024. Starting January 1, 2025, drugmakers will pay a 10% discount during the initial coverage phase and 20% during catastrophic coverage. That’s less than the 70% they give now-but it doesn’t matter because you won’t hit a gap. The $2,000 cap means your out-of-pocket spending stops growing once you hit that number. After that, you pay nothing. No more counting discounts. No more confusion. Just a clear limit.What to Do Right Now

If you’re not in the donut hole yet:- Review your 2024 Annual Notice of Change (sent in September). Look for changes to your drug costs.

- Call your pharmacy and ask: "What’s my total drug spending so far this year?"

- Ask your doctor: "Is there a generic version of my drug?"

- Visit GoodRx.com or NeedyMeds.org to check for coupons or patient assistance programs.

- Don’t panic. You still have options.

- Apply for Extra Help immediately-it can be retroactive.

- Use manufacturer programs. They’re still active until December 31, 2024.

- Ask your pharmacist if you can delay filling a prescription until next year to stretch your spending.

Final Thought: This Isn’t Just About Money

The donut hole wasn’t just a policy flaw-it was a human crisis. People chose between their meds and their rent. Between their health and their groceries. Between living and surviving. The $2,000 cap doesn’t just fix a broken system. It says something important: your health shouldn’t depend on how much money you have. In 2025, you won’t have to worry about the donut hole. But until then, use every tool available. You’ve earned this protection. Don’t let the system leave you behind.What is the donut hole in Medicare Part D?

The donut hole is a coverage gap in Medicare Part D where beneficiaries pay more out of pocket for prescription drugs after their plan and they’ve spent a set amount on covered medications-$5,030 in 2024. Before 2025, this phase had no spending cap, forcing many to pay 25% of drug costs with limited help. Starting January 1, 2025, the donut hole is eliminated entirely with a $2,000 annual out-of-pocket cap.

How do I know if I’m in the donut hole?

You’re in the donut hole when your total drug costs-including what you and your plan paid-reach $5,030 in 2024. Your plan will notify you, but you can also check your monthly statements or call your pharmacy. Use the Medicare Plan Finder tool to track your spending and estimate when you’ll enter the gap.

Can I avoid the donut hole by switching plans?

Yes. Some Medicare Part D plans have lower deductibles or better coverage before the gap. Using the Medicare Plan Finder tool, you can compare how much you’ll pay for your specific medications under different plans. People who switch based on their drug needs save an average of $1,047 a year.

Do manufacturer discounts count toward getting out of the donut hole?

Yes-for brand-name drugs only. The 70% discount from the drugmaker counts toward your out-of-pocket spending, helping you reach catastrophic coverage faster. For generics, there’s no manufacturer discount, so you pay the full 25% without help. That’s why people on expensive brand-name drugs often exit the gap sooner than those on generics.

What is Extra Help, and how do I qualify?

Extra Help is a federal program that reduces or eliminates Medicare Part D costs for low-income beneficiaries. In 2024, you qualify if your income is below $21,590 (single) or $29,160 (married), and your assets are under $17,220 (single) or $34,360 (married). It covers your deductible, lowers your copays, and removes the donut hole entirely. Apply at SSA.gov or call 1-800-772-1213.

Will my premiums go up in 2025 with the new cap?

Some experts worried premiums would rise because manufacturer discounts won’t count toward the new $2,000 cap. But CMS announced the average Part D premium in 2025 will be $34.70-down 1.1% from 2024. While some plans may adjust, overall premiums are expected to stay stable or even drop slightly due to lower administrative costs from simplified coverage.

What should I do if I can’t afford my meds right now?

Don’t skip doses. Call your pharmacy and ask about patient assistance programs from drugmakers. Visit NeedyMeds.org or RxAssist.org for free or low-cost drug programs. Talk to your doctor about switching to a generic. Apply for Extra Help immediately. And reach out to your state’s Medicare Savings Program-37 states offer additional help for low-income seniors.

eric fert

January 25, 2026 AT 18:03Let me tell you something nobody else will: this $2,000 cap is a gimmick. The real cost isn’t what you pay out of pocket-it’s what the insurers and pharma companies shift onto the rest of us through premiums and formulary restrictions. You think you’re saving $5,000? Nah. They’re just moving the goalposts. The 70% manufacturer discount disappearing? That’s the real loss. And don’t get me started on how they’ll ‘adjust’ the initial coverage phase to make sure you still hit a wall-just a fancier one. This isn’t reform. It’s rebranding with a smiley face.

And don’t even get me started on ‘Extra Help.’ You think the government’s gonna make it easy to qualify? Try filling out those forms when you’re 78, on dialysis, and your grandkid’s the only one who knows how to use a computer. It’s a trap wrapped in a promise.

I’ve been on Medicare since 2018. I’ve watched every ‘solution’ turn into a loophole for Big Pharma. This one’s no different. The donut hole’s gone? Sure. But the hole in your wallet? Still there. Just deeper.

And yes, I’ve used GoodRx. I’ve called manufacturers. I’ve split pills because I had no choice. You think they care? They’re billing you $12,000 a year for a drug that costs $800 to make. They don’t want you to be healthy. They want you to be dependent.

So yeah. Celebrate the cap. But don’t be stupid enough to believe it’s the end of the story. The real battle starts now-when they start pushing the next ‘innovation’ that costs you more in the long run.

I’m not anti-change. I’m pro-survival. And this? This is just the first act.

Read between the lines. Always.

Shawn Raja

January 26, 2026 AT 03:05Man. I just sat here for 20 minutes thinking about how wild it is that we’re finally saying ‘enough’ to drug companies.

You know what’s funny? Back in 2006, when Part D launched, everyone said ‘this’ll be a disaster.’ And guess what? It was. But now? We’re fixing it. Not perfectly. Not fast enough. But we’re moving.

I remember my aunt skipping her insulin because she couldn’t afford it. She told me ‘I’ll just drink more water.’ I cried for three days.

Now? She’s on Extra Help. She’s got her meds. She’s walking again.

This isn’t policy. This is dignity. And if you’re still mad about the manufacturer discounts disappearing? Look around. People are alive because of this. That’s the metric that matters.

Stop arguing about the math. Start celebrating the humanity.

And yeah. Use GoodRx. Call your pharmacist. Don’t be shy. You’re not asking for charity. You’re asking for what you paid for.

They owe you. And now? You’ve got leverage.

Use it.

Dan Nichols

January 26, 2026 AT 05:29Donut hole is gone? Sure. But you still pay 25% until you hit 2k. So what changed? You just stop paying after 2k. That’s not a cap. That’s a cliff. And the cliff is still a cost. And the cliff is still paid by someone.

Also generics don’t get manufacturer discounts. So people on blood pressure meds are still getting screwed. That’s not a fix. That’s a selective fix.

And Extra Help? You need to be poor enough to qualify but not so poor you can’t afford the paperwork. Classic.

Also the 90-day mail order thing? Most plans charge more for mail order if you’re in the gap. So that advice is misleading.

And the Medicare Plan Finder? Try using it when your internet cuts out every Tuesday. Or when you can’t read the tiny font.

This article reads like a pharma ad disguised as public service.

It’s not wrong. It’s just incomplete.

And that’s the problem.

They give you half the truth and call it victory.

Don’t be fooled.

Shweta Deshpande

January 27, 2026 AT 04:08Hi everyone, I just wanted to share something that helped me so much. My mom is 76 and takes 5 different meds. In 2023, she spent over $6,000 out of pocket. We were terrified.

Then we found NeedyMeds.org. We applied for Extra Help. We called her drug companies-AbbVie, Pfizer, you name it. One gave her a $500 coupon. Another gave her free meds for 6 months.

We switched to 90-day mail order. Saved $300 a month.

We checked GoodRx every single week. Sometimes the cash price was lower than her copay.

And the biggest thing? We didn’t give up. We kept calling. We kept asking. We didn’t let the system make us feel ashamed.

By December, she was under $2,000 for the year. And now? She sleeps better. She eats better. She smiles more.

This isn’t about politics. It’s about people. And people can change things when they don’t stay quiet.

If you’re struggling? Please, reach out. Call your pharmacist. Ask your doctor. Text a family member. You’re not alone. There are people who want to help. You just have to ask.

And if you’ve already done this? Thank you. You’re a hero.

Love you all.

-Shweta, from India but living in Texas now. We’re all in this together.

Jessica Knuteson

January 28, 2026 AT 10:08The $2,000 cap is a political gesture wrapped in a PR campaign. The real cost of drugs hasn’t dropped. The system just moved the burden from out-of-pocket to premiums and plan design. You think you’re winning? You’re just being sold a different kind of debt.

Manufacturer discounts disappearing? Of course they will. Why would a corporation give you 70% off when they can charge you 10% more in premiums and call it ‘affordable’?

And don’t get me started on ‘catastrophic coverage’-that’s just a fancy word for ‘you’re broke, we’ll let you live.’

It’s not reform. It’s redistribution of pain.

And the article? It’s a distraction. Focus on the cap. Ignore the fine print. That’s the playbook.

Stay woke.

Ashley Porter

January 29, 2026 AT 04:37So the donut hole’s gone. But the pharmacy benefit managers are still in charge. The list prices are still inflated. The rebates are still hidden. The formularies are still rigged. The cap just moves the friction point.

Also, the 70% manufacturer discount counted toward out-of-pocket. Now it doesn’t. That’s a backdoor rate hike disguised as simplification.

And the Medicare Plan Finder? Try entering your meds when your plan changes every October and the tool doesn’t update until November. You’ll get results that are 3 weeks out of date.

This isn’t a win. It’s a recalibration.

Still better than nothing? Sure.

Still a system designed to extract? Absolutely.

SWAPNIL SIDAM

January 30, 2026 AT 22:30I am from India. I came to US 10 years ago. I saw my neighbor cry because he could not buy his heart medicine. He said ‘I am American, but I am not enough.’

Now I see this news. I am happy. But I am also scared. Because in India, we have no such system. We pay everything. We wait in lines. We beg for discounts.

So I say: thank you for this change. But please, do not forget the people who still suffer. This is not just for Americans. This is for all humans.

One day, I hope India has this too.

With respect.

- Swapnil

Geoff Miskinis

February 1, 2026 AT 02:42Let’s be honest: the $2,000 cap is a PR stunt engineered by a Democratic administration that needed to look like they fixed something without actually confronting the root problem-pharmaceutical monopolies.

And yet, here we are. The donut hole is gone. The math is cleaner. The narrative is simpler.

But the cost of a single vial of insulin? Still $300.

The cost of a year’s supply of Humira? Still $70,000.

And the manufacturers? Still making 80% profit margins.

This isn’t reform. It’s theater.

But I’ll take the theater over the abyss.

For now.