When you pick up a prescription at the pharmacy, you might not think about why one drug costs $10 and another costs $75-even if they treat the same condition. The reason lies in something called a formulary, a hidden but powerful list that decides what your employer’s health plan will pay for, and how much you’ll pay out of pocket. For most people with employer-sponsored insurance, this system shapes their access to medicine every single month.

How Formularies Work: The Tiered System

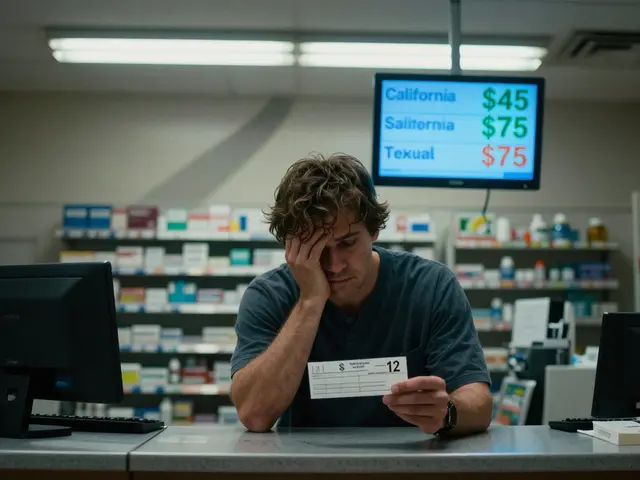

Your employer’s health plan doesn’t just cover all drugs equally. Instead, it uses a tiered formulary to group medications into levels based on cost. The goal? Encourage the use of cheaper, equally effective generic drugs while managing overall spending. Tier 1 is almost always reserved for generic medications. These are the same active ingredients as brand-name drugs, approved by the FDA as equally safe and effective. But because generic manufacturers don’t spend millions on advertising or repeat clinical trials, they cost 80-85% less. In most plans, you’ll pay just $10 for a 30-day supply of a Tier 1 generic. Tier 2 usually includes brand-name drugs that the plan prefers-often because they’ve negotiated a better deal with the manufacturer. Your copay here might be $40. Tier 3 is for brand-name drugs that aren’t preferred. These are typically older or more expensive options, and your out-of-pocket cost jumps to $75 or more. Tier 4 is for specialty drugs-medications for complex conditions like cancer, rheumatoid arthritis, or multiple sclerosis. These can cost hundreds or even thousands of dollars per month. Copays here are often a percentage of the total cost, not a flat fee. The system is designed to nudge you toward the cheapest option that still works. If a brand-name drug becomes available as a generic, the pharmacy benefit manager (PBM) automatically moves the brand version to Tier 4 and the generic to Tier 1. Suddenly, your $40 drug becomes a $75 drug. If you don’t switch, you pay more.Who Controls the List? Pharmacy Benefit Managers (PBMs)

You might not know it, but three companies-OptumRx, CVS Caremark, and Express Scripts-control the formularies for the vast majority of employer health plans in the U.S. These are Pharmacy Benefit Managers, or PBMs. They don’t sell insurance. They don’t make drugs. But they decide which drugs get covered, at what price, and at what tier. PBMs negotiate rebates with drug manufacturers. The higher the rebate, the more likely a drug gets placed on a lower tier. This is where things get complicated. A drug might have a list price of $500, but after rebates and discounts, the PBM pays only $225. That 55% gap between list price and net price is called the gross-to-net (GTN) spread. Here’s the catch: those savings don’t always go to you. The PBM keeps a portion of the rebate. Your plan might save money, but your copay stays the same. In some cases, the PBM even excludes a drug from the formulary entirely if the manufacturer won’t offer a big enough rebate. That means even if your doctor prescribes it, your plan won’t cover it-and you’ll pay full price unless you get an exception. In January 2024, each of these three PBMs removed more than 600 drugs from their formularies. That’s over 1,800 medications pulled at once. Many were brand-name drugs that didn’t offer high enough rebates. For employees taking those drugs, this wasn’t a minor change-it was a potential disruption to their treatment.Why Generics Are the Default Choice

The FDA has been clear for decades: generic drugs are not cheaper because they’re lower quality. They contain the same active ingredients, work the same way, and go through the same strict approval process as brand-name drugs. The only difference? They’re made after the patent expires, so other companies can produce them without repeating expensive research. For employers, the math is simple. Generic drugs save $3 billion every week. That’s more than $150 billion a year. That’s why 99% of large employer plans include prescription drug coverage-and why nearly all of them push generics first. But many employees still hesitate. They worry generics won’t work as well. Or they’ve been told by a doctor, “This brand is better.” Sometimes, that’s true-for a small number of drugs where bioequivalence is harder to guarantee. But for the vast majority, it’s not. Employers who want to reduce costs and improve outcomes are starting to educate employees. They send emails. They include info in pay stubs. They use HR portals to explain why switching to a generic isn’t a compromise-it’s a smart choice. If you’re on a chronic medication-like for high blood pressure, diabetes, or asthma-you’re likely on a generic already. You just didn’t notice the switch.

What Happens When Your Drug Gets Removed?

One of the biggest frustrations people face is when a drug they’ve been taking for years suddenly isn’t covered anymore. It’s not always because it’s unsafe. Often, it’s because the manufacturer refused to give the PBM a big enough discount. If your drug gets pulled from the formulary, you have options:- Ask your doctor for a generic alternative

- Request a medical exception from your insurer

- Switch to a different drug on the formulary

- Pay out of pocket

How to Find Out What’s Covered

You can’t rely on your doctor or pharmacist to know every detail of your plan’s formulary. They might not even know which PBM your employer uses. Here’s how to get accurate, up-to-date info:- Log in to your insurer’s website. Look for a “Drug List” or “Formulary” tool. Enter the name of your medication.

- Check your Summary of Benefits and Coverage (SBC). It should list typical copays for each tier.

- Call your insurer’s pharmacy line. Ask: “Is this drug on formulary? What tier is it? What’s my copay?”

- Ask if your employer offers a Price Assure Program or similar tool that automatically applies discounts for generics.

What You Can Do to Save

You don’t have to be passive in this system. Here’s how to take control:- Always ask: “Is there a generic version?”

- If your doctor says “this brand is better,” ask why. Request evidence.

- Use your plan’s mail-order pharmacy for maintenance meds. It’s often cheaper.

- Check if your plan has a drug discount card or savings program.

- If you’re on a high-cost drug, ask your employer if they offer a Chronic Illness Support Program. These programs can help reduce out-of-pocket costs.

Jaswinder Singh

December 3, 2025 AT 05:02Bro this system is rigged. I got switched from my brand-name asthma med to a generic and my lungs felt like sandpaper for two weeks. They don't care if it works, they just care about the rebate. My doctor said the generic was fine but it wasn't. Now I'm paying out of pocket and my bank account is crying.

patrick sui

December 4, 2025 AT 01:22TL;DR: PBMs are middlemen who profit from your suffering. They don't care about outcomes, only gross-to-net spreads. The 'savings' never reach you. It's capitalism with a stethoscope. 🤒💸

Declan O Reilly

December 4, 2025 AT 11:49so like... if the drug works the same why do we even have tiers? is it just a psychological trick? like 'oh this one's cheaper so it must be better'? i feel like this whole thing is a giant game of musical chairs with pills and my paycheck is the chair getting taken.

Kay Lam

December 6, 2025 AT 01:09I've been on a generic for hypertension for 7 years and never noticed the switch. My doctor told me it was the same, and honestly? It was. I saved $50 a month. My employer saved thousands. Everyone wins except the PBM who keeps the rebate. We need transparency. Not just for drug costs but for how much of that rebate actually goes to the patient. If the drug costs $10 to make and I pay $10, why does the PBM pocket $30? That's not savings, that's theft dressed up as healthcare.

Bee Floyd

December 8, 2025 AT 00:56My employer just sent an email about formulary changes. I checked my meds. My $10 generic got bumped to Tier 2. My copay went from $10 to $40. No warning. No explanation. Just... a notice. I called my insurer. They said 'it was a rebate issue.' So my health is now a negotiation tactic between a pharmacy and a drug company. Cool. I'm gonna go cry into my $40 pill bottle now.

Shashank Vira

December 9, 2025 AT 13:35Let me be blunt: the average American has no idea how broken this system is. You think you're getting 'affordable' care? You're getting curated, rebate-driven, profit-maximized pharmaceutical roulette. The FDA says generics are equivalent? Fine. But equivalence doesn't mean identical pharmacokinetics. For some of us, the difference between 98% and 102% bioavailability is a seizure. Yet PBMs don't care. They care about the bottom line. And you? You're just a data point in their quarterly report.

Lydia Zhang

December 10, 2025 AT 10:00generics are fine

Matt Dean

December 10, 2025 AT 15:04Anyone who still thinks brand-name drugs are 'better' is either being manipulated by pharma ads or has never read a single FDA bioequivalence study. You're not special. Your body isn't magic. If the generic works for 99% of people, it'll work for you. Stop being a entitled snowflake and save your cash. Your wallet will thank you more than your ego ever will.

Walker Alvey

December 10, 2025 AT 17:23So let me get this straight - the same drug, same active ingredient, same FDA approval - but if the manufacturer won't kick back enough cash, you get screwed? That's not healthcare. That's a mafia protection racket with a pharmacy counter. And we call this a system? Nah. We call it capitalism with a white coat.

Courtney Co

December 12, 2025 AT 02:17I just found out my anxiety med got pulled from the formulary. I cried in the pharmacy aisle. I don't even know what to do. My doctor said 'try this other one' but what if it makes me feel like a zombie? What if I lose my job? What if I can't sleep? Who even cares? Not the PBM. Not my employer. Just me. Again. Always me.

Patrick Smyth

December 13, 2025 AT 22:01My wife's rheumatoid arthritis drug was removed. We had to fight for 3 months for an exception. They asked for bloodwork, letters from 3 doctors, a signed affidavit from our cat. We won. But the stress? The hours? The fear? That's the real cost. Not the $75 copay. The emotional toll. That's what nobody talks about.

Adrian Barnes

December 14, 2025 AT 07:36The entire structure is a grotesque parody of healthcare. PBMs are not healthcare providers. They are financial intermediaries with zero clinical accountability. Their incentives are misaligned with patient outcomes. They profit from exclusion. They thrive on obscurity. And we tolerate this because we're too distracted by TikTok and Netflix to demand systemic reform. This isn't broken. It's designed this way.

Conor Forde

December 15, 2025 AT 22:18Let me tell you what's REALLY happening - PBMs are the vampires of modern medicine. They don't make the drugs. They don't deliver them. They just suck the life out of the price tag and leave you holding the empty vial. And the worst part? You're supposed to be grateful they let you buy it at all. Meanwhile, the drug company that made it gets paid $225, the PBM pockets $275, and you pay $75 for the privilege of not dying. This isn't capitalism. This is a horror movie written by a hedge fund manager.

Jeremy Butler

December 17, 2025 AT 16:28It is a matter of considerable scholarly concern that the structural architecture of pharmaceutical benefit management, while ostensibly optimized for fiscal prudence, systematically externalizes the burden of therapeutic uncertainty onto the individual patient, thereby subverting the foundational ethical tenets of medical beneficence. The absence of rebate transparency constitutes a de facto breach of fiduciary duty owed by third-party administrators to insured populations. A regulatory intervention, predicated upon mandatory disclosure of gross-to-net spreads and the direct pass-through of rebates to beneficiaries, is not merely advisable - it is a moral imperative.